Dealing with the Challenges of International Freight Rates

Freight Rate Developments

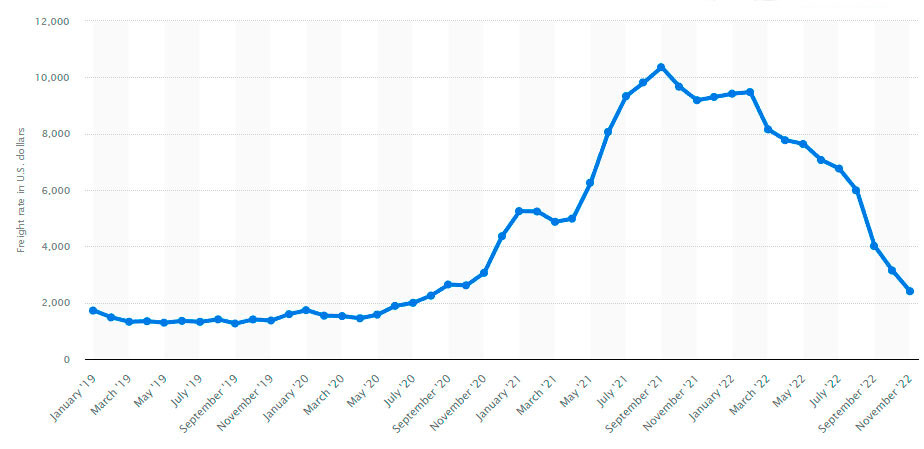

International air and ocean freight rates have been dropping steadily since January 2022. Whilst still slightly over or by the time of reading just on 2019 pre-Covid levels, it could be said rates were for a few months on a realistic level.

For many years prior to the Covid pandemic, international freight rate evolution was a race to the bottom leading to structural profitability issues for carriers. Shippers were in control of freight rates and were able to establish low long-term contract rates at or under carrier cost price. At the same time, the spot rate market offered limited profit margins and was not able to compensate for those losses incurred on the larger contract volumes. In addition, the increased sizes of container vessels being delivered into the market kept vessel capacity availability far above the actual demand for space. This resulted in very few occasions in a year where either peak demand or limited capacity rates would surge for a short period of time.

Shortly after the start of the Covid pandemic, ocean vessel and airplane capacity were taken out of the market in high volumes, as a knee-jerk reaction to early lockdowns, limited production output, and rapidly declining consumer demand. Prices skyrocketed shortly thereafter, due to a massive increase in customer online shopping demand and China rebooting its economy and exports after an initial lockdown.

Many ocean vessels were scrapped for metal during the first Covid wave. Freight rates soared and remained extremely high, whilst demand for vessel capacity was higher than its availability. This represented a unique time when ocean carriers were recuperating from their long-term losses. Yet for shippers at the same time, worries of high freight rates were combined with longer stocks in transit due to container, driver, and terminal handling capacity shortages including people isolating at home due to Covid infections.

During the second Covid year, cargo capacity continued to be added and gradually exceeded the declining demand levels. Freight rates have come down to a realistic level since.

Source: Statista

However, an end to the decline in freight rates is not in sight yet. Momentary stability was seen during the Chinese New Year which is historically a period of significant rate increases related to temporarily halted production and limited vessel capacity. Yet this year, this represented nothing more than a slight uptick in rates followed by further pressure on rates.

Carriers are unable to manage global capacity in a sustainable manner and therefore 2023 seems to be the year when shippers will be in full control of rates once more. Long-term contract rates are still declining, and it will likely take at least until the end of 2023 or possibly well into 2024 for the market rates to recover and move upward.

Ideally, rates would hover around the point where carriers obtain a decent return on their investment and avoid massive swings in costs for shippers which create a constant uncertainty in cost and timely product availability. It would certainly lead to more stable and sustainable supply chains. However, this is not a matter in the hands of cargo carriers only. We are just as responsible for this outcome.

Fragile Supply Chains

Together we have been contributing to the fragility of supply chains and the consequences we are faced with today. This fragile state results in reducing stocks in warehouses, implementing near or just-in-time delivery models, and moving production to distant low-cost production locations. As a result, an unhealthy global imbalance has been created where products are manufactured, stored, and distributed to support flexible consumption demands at the lowest possible costs. Where companies placed their trust, or hopes, in a global economy that would remain stable enough to support these stretched and fragile supply chains.

Pre-Covid, signs were already noticeable that collectively we had been overstretching supply chains in this endless drive for cost saving. The Covid pandemic burst our bubble resulting in long delays in product deliveries, empty shelves, higher costs, and consumption shock effects rippling through the global economy.

Adding to this challenge were rapidly changing weather patterns, growing geopolitical tensions, labour and resource shortages, the war in Europe resulting in an energy crisis, humanitarian crises, and free market constraints. This culminated in an extremely volatile mix of supply chain disruptions impacting businesses and people’s lives in ways we haven’t seen before. Going forward, instead of stabilizing freight rate expectations more extreme swings in freight rates should be expected.

Change is inevitable

Change is needed from an economical and logistical point of view, but most importantly also taking care of our environment and a sustainable future. Changes must and will come to how and where materials for production are sourced from, how and where the transformation of these resources into products takes place, and post-consumption how and where these products will be recycled as part of a circular economy. The era of cheap production, fast consumption, and simple disposing of is coming to an end.

For these reasons, many companies are already reviewing their global sourcing, production, distribution, and recycling strategies. Near or onshoring is often cited as a strategy to become less dependent on production out of the continent and avoid stretched supply chain impacts. In addition, companies are also applying multi-supplier and multi-production location setups with an increase in local and regional storage capacity which will all lead to cost increases. It is therefore recommended that investments be made in the systems used to run businesses to offset increased costs, retain acceptable stock levels, balance production costs and not expose themselves to the continuous challenges in the transportation markets. An evolution in enterprise sourcing, production, and supply chain systems is needed to keep running the business efficiently.

New Ways of Automation

Businesses use an array of systems to manage their operations. Many companies leverage integrated Enterprise Resource Planning (ERP) tools such as Oracle or SAP or multiple systems combined together to execute business plans. These planning solutions enable companies to execute the sourcing, production, and delivery of goods according to forecasted demands in sales and agreed-upon contracts for timely sourcing and delivery.

Forecasts in sales and related contracts for sourcing, production, and delivery are often made on an annual basis. These are complex plans to which amendments can be made along the way of execution but are often too rigid to adapt to larger and continuously changing inputs.

With the awareness of all disruptive factors that can impact a business, it must be acknowledged that for businesses in today’s environment, a business plan cannot be solely based on long-term expectations, averages from the past, and what information is available at the moment of creating the continuous plans. Establishing the means to respond to fast-paced changes in purchasing, production, and logistics amendments is critical. Creating a process to continuously (and where possible in an automated manner) respond to actual and potential disruptions as well as opportunities that can impact the holistic end-to-end supply chain is equally important in the form of a fluid business plan. This is an ideal methodology to manage cost optimizations, meeting customer demand whilst retaining minimum stock levels.

Applying the right mix of predictive and prescriptive analytics, machine learning (ML), and artificial intelligence (AI) solutions that can propose or automatically perform changes in the company’s supply & demand model will become an important key to future success.

Agile Freight Management

Many supply chain software providers are developing automated AI and ML solutions to manage the logistics components of such an automated feed of actual and potential disruptions and opportunities. These solutions are implemented to enable the company’s global overview of product stock levels in all manufacturing and storage sites, products in transit, and product supply & demand planning which allows for detailed risk and opportunity planning.

Such insights gained can then in turn be used to manage freight in an agile way based on actual needs and live predictions prioritizing critical product movement. Potentially at a higher cost, yet compensated by optimizing non-critical freight movements. Fourth-party logistics providers (4PL) are well-suited to bring information together and implement and execute agile freight management.

With solutions deployed to manage and optimize product flow based on real-time information, the level of freight rates will become less of a concern. Being able to trust an agile optimized logistics model where inefficiencies are reduced and opportunities are utilised will provide business leaders and decision-makers peace of mind.

Freight Rate Insights

Many businesses have concerns regarding whether they are afforded “good rates” for their freight movements. In volatile markets, where freight rates are constantly changing, making decisions on long-term contract rates, block space agreements, or benefitting from the spot market can easily feel like gambling. On top of that, changing logistics service providers for lower rates can result in potential service issues. And that reliability of service is often turning out to be as important, if not more, as the costs of freight related to it.

Being informed of validated market price levels in comparison to own freight costs provides insight into whether the rates are considered “fair” or not. This can result in contract renegotiations with incumbent providers based on independent market intelligence and then only when a lack of alignment requires the business to, drive a service provider change.

Various tools and solutions are available in the market, often based on a requirement to register their own freight buying rates to gain the benefit of rate comparison against other shippers on the same trade lanes. Freight indexes are provided on global trade lanes to understand trends from the past leading to expectations for the future. Additionally, there are extra services in the marketplace available to provide insight into actual spot market rates, freight tender management, freight online booking, and more.

Being aware of how the freight market evolves and being able to include that confidently in your business strategies is by itself a potential game changer to efficiently deal with the continuous fluctuations of freight rates.

Some leading online service providers in this area are:

- Xeneta – an ocean and air freight rate benchmarking and analytics platform

- Drewry – an international provider of research and consulting services to the maritime and shipping industry

- Freightos – powering painless global freight comparison, booking, and management

- Statista – empowering people with data

In addition to the above, there are a few interesting startup platforms and marketplace projects for freight rates comparison and shipping automation evolving in this space. They are determined to compete with bigger known rivals, who have been established in the market for decades, if not more. And who knows, some of them may be well equipped with a passion to succeed on their way to freight and supply chain industry disruption. There are certainly some promising innovations happening, as we speak, watch this space.

Strathsquare is a seed stage project initiator that provides required resources to entrepreneurs and innovators. We are driven by a sense of urgency to transition away from unsustainable technologies and processes, we believe that what we do should have a genuinely positive impact on society and our environment.

If you have an innovative idea

We are committed to supporting innovators who have the potential to make businesses more sustainable and for all.